This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Evaluator Group’s latest research on hyperconverged infrastructure vendors assesses the top five offerings, plus niche players, including their differentiators.

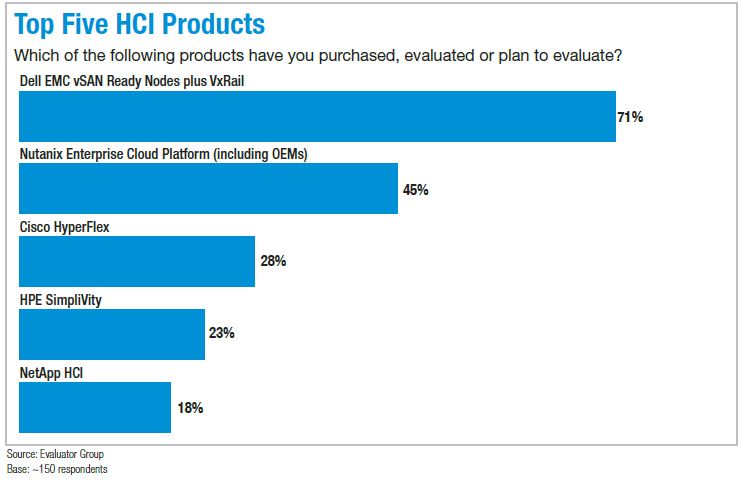

The hyperconverged infrastructure (HCI) market is consolidating, with VMware’s vSAN and Nutanix the dominant products. Based on the latest Evaluator Group survey, vSAN – when combined with Dell EMC’s VxRail, which is based on vSAN – was chosen for deployments or evaluations by over 70% of respondents. Nutanix Enterprise Cloud Platform (as well as OEM products running Nutanix software) was next, cited by 45% of respondents. Although significant, and impressive, this doesn’t mean the HCI market will consolidate around these two vendors or that they have a monopoly on HCI technology. The products offered by some of the other major platform vendors have some strong technology as well. In this article, we’ll discuss hyperconverged infrastructure vendors including Cisco, HPE and NetApp; what they bring to the table; and why they should be considered. We’ll also look at two interesting independents, Pivot3 and Scale Computing, that have managed to do well in a market that strongly favors large vendors.

As a technology, HCI continues to grow in the enterprise. In fact, data from our study shows HCI crossing a threshold in the past year to become a viable solution for most workloads in the majority of companies we surveyed. These enterprises see the value in hyperconverged technology as part of their infrastructure mix, and their platform vendor of choice needs to have an HCI offering.

The third, fourth and fifth most frequently cited products in the study are from Cisco, HPE and NetApp, respectively. These products are described below, with info on some of their differentiators. (Evaluator Group maintains comparative research on 17 hyperconverged infrastructure vendors and their products, including all the major players in the market.)

Cisco HyperFlex. Cisco HyperFlex clusters are made up of three to 32 HCI nodes in hybrid or all-flash configurations. HyperFlex also supports up to 32 UCS server compute nodes. This capability to connect new or existing independent UCS servers into the HCI cluster and share its common storage pool is unique. Incoming data is synchronously mirrored and striped across all nodes in the cluster to satisfy data availability requirements. HyperFlex moves data blocks as needed, from all nodes in parallel, to support VM read operations. Each HyperFlex cluster includes Cisco’s UCS Fabric Interconnects, which consolidate network connections (another unique feature) and use software-defined networking technology to move data between HyperFlex nodes with a single network hop, improving cluster performance and consistency, according the company.

HPE SimpliVity. SimpliVity, founded in 2009, helped to create the HCI product segment, before it was acquired by HPE in 2017 to replace the legacy StoreVirtual product. HPE SimpliVity Data Virtualization Platform creates a single data store for the cluster that applies capacity optimization (a unique feature that’s like single instancing), deduplication and compression across nodes, at ingest, to improve data efficiency and decrease costs. HPE SimpliVity uses a PCIe offload card to improve performance – the only HCI to do this, although Cisco recently announced a similar capability. The company guarantees 10-to-1 data reduction but claims 50-to-1 is typical. HPE SimpliVity clusters are made up of three to 16 nodes (all-flash only) but can be run as a single node with internal RAID 5 (most HCIs can’t do this). Data protection (an original SimpliVity feature) and disaster recovery are built-in features.

NetApp HCI. NetApp HCI is based on software that runs the SolidFire all-flash OS on industry-standard server hardware and commodity storage devices. It has a disaggregated architecture that separates storage and compute resources into separate nodes, allowing for a more granular, efficient expansion than most other HCI solutions that include both resources in the same chassis. None of the other major players in HCI have a disaggregated architecture, although scaling storage and compute independently is a concern for HCI users, based on our research. NetApp HCI clusters contain a minimum of four storage nodes and two compute nodes, but they can expand to up to 100 nodes in any combination. SolidFire’s Helix data protection scheme distributes two redundant copies of each data block across all nodes in the cluster, ensuring data resiliency and enabling nondisruptive upgrades. NetApp HCI has particularly strong performance, based on Evaluator Group testing, which means fewer storage nodes are required to support a given number of VMs, lowering TCO.

In addition to these large vendors, two independents, Pivot3 and Scale Computing, both long-time players in the HCI space, have done well carving out a piece of the market.

Pivot3. One of the first players in the hyperconverged market space, Pivot3 was founded in 2003 and built a significant installed base in video surveillance, among other use cases. Its internal data protection is based on an erasure coding technology that provides better efficiency and data resiliency than traditional mirroring and even RAID 5/6 schemes (which other vendors often call “erasure coding” as well). In addition to this technology, Pivot3 also offers sophisticated quality-of-service features. The rise of big data analytics and AI, especially involving images, puts Pivot3’s technology in a good position as the HCI market focuses on providing solutions for computing at the edge.

Scale Computing. Scale Computing was founded in 2009, initially building a scale-out, software-defined storage system that provided the foundation for its HC3 hyperconverged infrastructure appliance. The HC3 platform is a cluster of three or more single-node appliances that run the company’s HyperCore software at the Linux kernel level, not as a VM like most other HCI solutions. This software is designed to use fewer CPU cores than other HCIs, and half the memory. Each node runs a built-in hypervisor, a KVM derivative, that’s included with the system; there’s no option to use another hypervisor. These characteristics enable Scale to keep the cost down and make a solution that appeals to the SMB market and as a ROBO solution for very large retail companies and enterprises with smaller, distributed locations.

Although there are clear leaders in the HCI space, all the major infrastructure vendors have their own solutions. Companies exploring this technology should consider these other vendors, as well, since most have some unique and differentiating characteristics. For more information on any hyperconverged product, go to EvaluatorGroup.com, or check out the company’s latest study, Converged and Hyperconverged in the Enterprise 2019.